By Leila Sullivan

In May, we welcomed spring blooms and warm weather, while staying engaged with the latest health policy research. This month we read about potential effects of the reconciliation bill on provider revenue and uncompensated care, Rhode Island’s affordability standards and their effects on hospital prices, and coverage retention and plan switching following changes in premiums.

Reconciliation Bill and End of Enhanced Subsidies Would Cut Health Care Provider Revenue and Spike Uncompensated Care

Fredric Blavin. Urban Institute. May 2025. Available here.

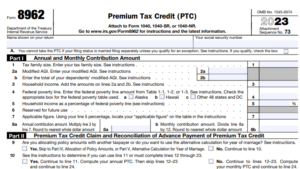

The Urban Institute combined findings from two previous analyses, along with recent Congressional Budget Office (CBO) projections, to determine the impact of the reconciliation bill (HR 1) and elimination of the enhanced premium tax credits (PTCs) on provider revenue and uncompensated care costs over the next 10 years.

What it Finds

- The number of uninsured people in the United States is expected to increase dramatically, with CBO projecting almost 16 million people becoming uninsured as a result of the expiration of enhanced PTCs, and the Medicaid and Marketplace provisions in HR 1.

- If the reconciliation bill passed and enhanced PTCs were allowed to expire, total healthcare expenditures across all payers would fall by approximately $1.03 trillion between 2025 and 2034.

- If the reconciliation bill were enacted and enhanced PTCs allowed to expire, the volume of uncompensated care would increase by $278 billion between 2025 and 2034, placing disproportionate financial strain on hospitals and clinics, particularly in underserved and rural areas.

Why it Matters

These findings are significant because they underscore the broader systemic consequences of enacting the reconciliation bill and rolling back enhanced subsidies. A sharp increase in the uninsured population would not only reduce access to necessary health services for millions of individuals but also cause financial harm to hospitals and clinicians through reduced utilization and increased uncompensated care. This dynamic threatens the financial stability of hospitals—particularly safety-net and rural providers—and may lead to service cutbacks or closures.

Rhode Island’s Affordability Standards Led To Hospital Price Reductions And Lower Insurance Premiums

Andrew M. Ryan, Christopher M. Whaley, Erin C. Fuse Brown, Nandita Radhakrishnan, and Roslyn C. Murray. Health Affairs. May 2025. Available here.

Researchers for Brown University used a series of national data sources from the period 2006–22 to compare hospital prices, margins, and insurer premiums and fees in Rhode Island and comparison states before and after the initiation of Rhode Island’s affordability standards in 2010. Significantly, these affordability standards include an annual cap on the rate of growth for hospital prices in the commercial insurance market.

What it Finds

- The study found that the state’s affordability standards correlate with substantial decreases in negotiated hospital prices, yielding an average decline of around 9% relative to prices in comparator states.

- Hospital operating margins after implementation of the Rhode Island affordability standards were lower than in comparator states and the standards reduced hospitals’ commercial revenue by nearly $160 million annually.

- Those savings were largely passed onto employers and plan enrollees.The affordability standards reduced aggregate premiums and out-of-pocket spending by an average of $87.7 million annually, with most of the savings derived from fully insured employer premiums (-$64.1 million), followed by enrollee premiums (-$20.8 million) and enrollee cost-sharing (-$2.9 million). Premium reductions for fully insured members exceeded $1,000 per member per year by 2022.

- Despite the reduction in hospital prices, there was no associated decline in hospital utilization rates or measurable deterioration in quality indicators, suggesting that cost containment did not compromise care delivery.

Why it Matters

These findings are significant as they provide empirical support for the efficacy of state-level hospital price regulation in achieving cost containment without compromising care quality or access. Rhode Island’s affordability standards not only reduced negotiated hospital prices but also contributed to lower private insurance premiums and out-of-pocket spending, demonstrating that targeted regulatory interventions can influence broader market dynamics. Importantly, the absence of negative effects on utilization or quality reinforces the potential for such policies to serve as sustainable mechanisms for improving affordability in other state health systems facing rising healthcare costs. The evidence supports the conclusion that state affordability regulations, when applied to hospital pricing, can effectively curb growth in health care cost while maintaining insurance market stability

Coverage Retention and Plan Switching Following Switches From a Zero- to a Positive-Premium Plan

Coleman Drake, Dylan Nagy, Sarah Avina, Daniel Ludwinski, and David M. Anderson. JAMA Health Forum. May 2025. Available here.

Researchers reviewed HealthCare.gov data from 2022 through 2024 to determine if lower-income Marketplace enrollees lose or change coverage when they are defaulted from a zero-premium silver plan to a silver plan with a premium.

What it Finds

- When enrollees face a transition from a $0 silver plan to a silver plan with a premium, there is a 7% decrease in automatic re-enrollment.

- Although overall active enrollment remained unchanged, turnover from $0 premium silver plans to silver plans with premiums led to 13.4% fewer enrollees re-enrolling in their previous plan and a corresponding 15% increase in enrollees switching to new plans.

Why it Matters

These findings reveal how even modest changes in plan premiums can disrupt coverage continuity for low-income enrollees in the ACA Marketplace. The decline in automatic re-enrollment and increased plan switching suggest that administrative complexity—introduced by shifts from zero- to positive-premium plans—may function as a barrier to stable insurance coverage. Given the high prevalence of such turnover across counties, the potential for widespread disenrollment is significant, particularly if the proposed Marketplace integrity rule is finalized, the budget reconciliation bill is enacted, and/or enhanced subsidies expire in 2026. This study underscores the importance of minimizing administrative friction and reducing financial barriers to preserve equitable access to health insurance.